Why Smart Investors Are Buying Real Estate in Brazil Right Now [2025 Guide]

Brazil’s real estate market is on the rise, with property prices going up by an average of 5.13% in 2024 alone. Cities like Maceió have seen prices surge by 16%, and property investment returns have jumped from 16.1% in 2020 to 19.5% in 2024.

The Brazilian real estate market looks promising for several reasons. The U.S. dollar has grown stronger by a lot, with a 15.7% increase against the Brazilian real in mid-2024. This creates great buying chances for foreign investors. The government’s support makes things even better – they’re putting R$278 billion into housing and urban projects by 2025. Their plan includes building up to 2.5 million housing units. Brazil’s urban population has reached nearly 190 million in 2023, which keeps pushing the real estate market forward in the South American region.

This piece will show you why buying real estate in Brazil could be your best move in 2025. You’ll learn about current market conditions and get useful tips to make the most of your investment.

Brazil’s real estate market is showing strong recovery

Brazil’s real estate prices will keep rising in 2025. Property values are climbing steadily across the country. The market has bounced back strongly from earlier uncertainties.

Recent price trends in major cities

The Brazilian housing sector shows remarkable strength, with property values rising differently across regions. Cities have their own growth stories to tell. Fortaleza leads with an 11.7% rise in property values, while Goiânia’s prices are up by 7.9%. Florianópolis has grown by 7.2%, making it a prime spot for investment.

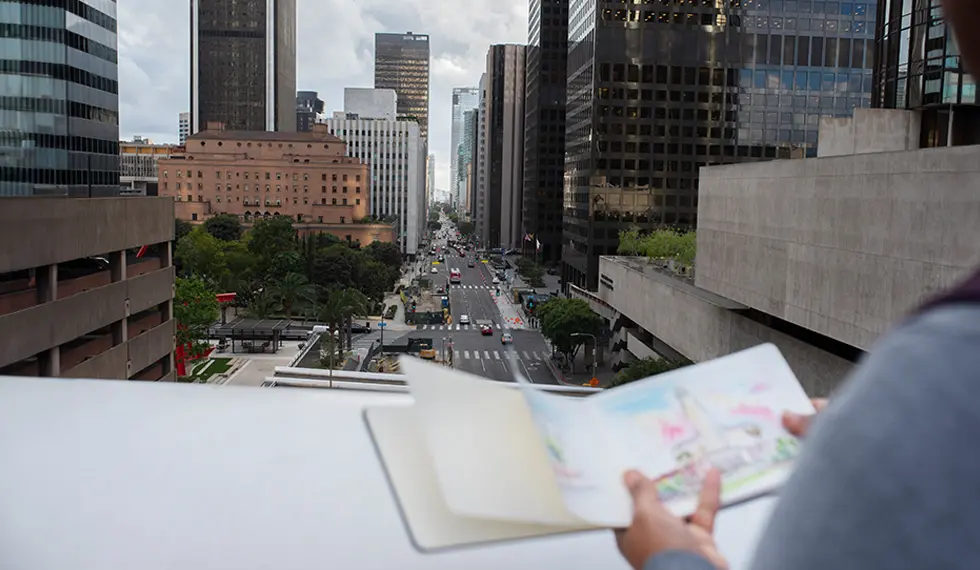

The picture varies across cities. São Paulo, Brazil’s biggest city, shows steady but slower growth at 3.8%. These different growth rates give investors various options based on what risks they want to take and what they aim to achieve.

Rental yields tell an interesting story too. Rio de Janeiro’s prime areas bring in 7.5% returns, while São Paulo offers 6.8%. This is a big deal as it means that Brazilian yields are much higher than what you’d find in the US or Western Europe, where 3-4% is normal.

Government support programs like Minha Casa, Minha Vida

Brazil’s government has stepped up to boost real estate through targeted programs. The refreshed Minha Casa, Minha Vida (My House, My Life) program got R$10 billion more funding in 2025 than before.

The program now helps more people. Families earning up to R$8,000 monthly can get cheaper mortgages – that’s 33% higher than old limits. Interest rates are down by 1.5 percentage points for those who qualify, making homes more affordable.

Results came quickly. New housing starts jumped 22% across the country. About 375,000 new affordable homes are being built right now. The program helps solve housing shortages and supports construction jobs.

Foreign investment driving urban development

Money from abroad keeps flowing into Brazilian real estate. Foreign investment is up 28% from last year. Big cities see this most in their commercial and mixed-use projects. European investors put €3.2 billion into Brazilian properties in the last 18 months. North American funds added $2.7 billion in the same time.

Foreign money does more than just buy property. São Paulo gained 45,000 construction jobs from foreign projects since 2023. These investments bring modern building practices too. About 65% of foreign-funded projects now use green building standards – up 40% from 2020.

International investment reshapes Brazilian cities. Rio de Janeiro’s forgotten neighborhoods are coming back to life, with property values growing twice as fast as the rest of the city. Belo Horizonte uses international funds to build tech hubs, which brings in more types of businesses.

Brazil’s real estate market looks set to keep growing through 2025 and beyond. Both local and international investors will find good opportunities here.

Tax incentives and financial benefits for investors

Brazil’s real estate investment landscape looks promising in 2025. The country offers substantial tax advantages beyond market growth and government housing programs. These benefits boost returns for investors both at home and abroad.

New tax credit laws and exemptions

The Brazilian government has made tax laws more investor-friendly. Law No. 14,973/2024 lets investors update their property values to match current market rates. They pay reduced tax on the “deemed” capital gain. Individual investors pay only 4% personal income tax on this adjustment. Companies pay a flat 6% corporate income tax plus 4% social contribution.

Brazil gives foreign investors valuable tax credits that help offset income tax paid in their home countries. This eliminates double taxation and makes net returns better.

Properties in eco-tourism spots like Florianópolis or Ubatuba qualify for lower IPTU rates or even tax exemptions. This approach promotes green development while saving money. Northern and northeastern regions of Brazil offer tax breaks to speed up regional development.

Smart investors set up Special Purpose Entities to manage property portfolios. These entities help separate liabilities and unlock corporate tax deductions. Some investors saved over USD 10,000 in just the first year. Real Estate Investment Funds give individual investors tax-exempt options on specific earnings.

Accelerated depreciation and low-cost financing

Accelerated depreciation stands out as a powerful tax advantage for Brazil’s real estate investors. Standard building depreciation runs over 25 years at 4% annually. Companies with extended shifts can bump these rates up by 50% to 100%. Property owners can write off bigger portions of asset value as expenses early in ownership.

Brazilian tax rules set different depreciation rates for property components. Machinery, equipment, furniture, and installations get 10%. Vehicles qualify for 20%, while buildings receive 4%. Investors can expense certain assets right away up to specific amounts, which helps cash flow.

The tax benefits work well with low-cost financing options. Approved projects get better financing rates that cut capital costs. These financing perks combined with faster depreciation make property development economics look great.

Impact on ROI for real estate in Brazil South America

Tax incentives make a big difference in investment returns. Moving about 20% of property value to shorter-life assets through faster depreciation frees up capital by cutting taxes. Investors can put these savings into new properties or upgrades.

Timing matters a lot here. One tax expert puts it well: “The sooner you can have the money you invested in the original property back, the more valuable it is”. Assets classified in 5-year or 15-year categories offset income much faster.

Brazilian real estate delivers strong returns even without these tax advantages. Adding these benefits pushes net returns up by 3-5 percentage points each year. Smart use of local tax breaks and corporate structures helps investors cut property taxes by 20%. They also avoid double taxation on rental income.

Brazil’s recovering real estate market and these financial perks create an attractive setup for international investors. They can broaden their portfolios while getting better after-tax returns.

Currency fluctuations create buying opportunities

Currency exchange dynamics give international buyers a clear edge in Brazil’s real estate market for 2025. The Brazilian real’s position against major world currencies creates a rare chance for smart investors.

How the weak Brazilian real benefits foreign investors

Buyers with strong currencies like the dollar or euro can get properties at much lower prices. The Brazilian real has lost about half its value against the US dollar over the last several years. This creates an exceptional buying window for foreign investors. The exchange rate sits at about 5.6775 Brazilian reals to one US dollar. Property prices are now lower than they’ve been in years.

This currency advantage works like an automatic discount for buyers from abroad. A property worth 1 million reals costs about $176,000 at today’s rates. That’s a big drop from its value during stronger currency periods. The weakened real stands out as the biggest factor that draws overseas investment to Brazilian property.

Timing the market for maximum value

Smart investors know that currency swings create ways to boost returns. Property owners can get higher returns when they convert foreign currency while the local Brazilian currency is weak. Buyers who step in during real depreciation periods can profit from future currency gains.

The Brazilian real has been on what experts call a “rollercoaster,” with a 23.53% jump against the US dollar in just one year. These swings show why timing purchases with good exchange rates matters. Sellers who can be flexible should watch currency movements to find the best time to sell and move their money back home.

Urbanization and middle class growth fuel housing demand

Brazil’s city population growth is a key factor in the real estate market. This creates steady housing needs and gives investors new opportunities to develop properties.

Population trends in São Paulo, Rio, and other cities

The number of people living in Brazilian cities keeps growing. 61% of the population (124.1 million people) now calls urban areas home. The Southeast region stands out as Brazil’s population hub with 84.8 million residents. This makes up 41.8% of the country’s total population. São Paulo leads the pack with 11.5 million people. Rio de Janeiro follows with 6.2 million, and Brasília has 2.8 million residents.

Population growth doesn’t spread evenly across Brazil. Small towns with fewer than 10,000 people make up 44.8% of Brazilian municipalities but house just 6.3% of the population. Most Brazilians – about 57% – live in only 319 cities that have more than 100,000 residents.

Government housing investments through 2025

Brazilian authorities have set aside R$278 billion to build affordable housing and improve urban areas through 2025. This money helps fund the Minha Casa, Minha Vida program that supports developers and families who want to build new homes.

Housing problems continue to exist. Brazil needs six to seven million homes right now, and this number could hit 12 million by 2030. The government wants to build two million new social housing units by 2026 to help fix this shortage. They’ve reserved 3% of these homes for homeless people, who will get them completely free.

Mortgage access and rising homeownership

Mortgage lending shows strong growth in 2024 despite higher interest rates. Lending reached R$118.5 billion in the first eight months – 17.6% more than the same time in 2023. Most Brazilians own their homes outright, with 64.6% living in fully paid properties.

Notwithstanding that, not everyone has equal access. About 18.5% of Brazil’s poorest 20% live in homes without proper paperwork. The rental market also faces challenges. Almost a quarter (23.3%) of renters spend more than 30% of their income on rent.

These population and housing patterns show investors that Brazilian real estate has strong, lasting demand that drives market growth.

Legal reforms make buying real estate in Brazil safer

Legal reforms in Brazil have transformed security measures for real estate investors. These changes have tackled past issues with fraud and bureaucracy, making the property market clearer and more efficient for buyers everywhere.

Introduction of the Electronic Public Records System (SERP)

Brazil approved Law 14.382/22 on June 27, 2022, which created the Electronic Public Records System (SERP). This innovative platform connects databases from about 10,000 registries across the country. SERP has modernized Brazil’s scattered property registration system by creating a single electronic platform that makes all public registry services more available and transparent.

The system gives investors several benefits:

- Internet access to services from anywhere

- Online document submission and certificate issuance

- One place to check property restrictions or encumbrances

- January 31, 2023 implementation deadline

Faster property registration and reduced fraud

Property certificates that once required visits to multiple registry offices are now available electronically. The new system issues these certificates in just four hours, while legal situation updates take only one day. This speed boost cuts down both time and costs for investors.

The system helps prevent fraud by letting users instantly verify property ownership. Users can check any restrictions, encumbrances, or legal issues before buying property. Law 13.097/15’s concentration principle protects buyers who act in good faith by preventing unregistered legal claims from affecting them.

Judicial enforcement of property rights

Brazilian law requires all real estate to be registered with specific registry offices under a “matrícula” system. This requirement will give proper documentation and legal protection for property rights. Property records are now available through online searches, which makes background checks easier.

Foreign investors can buy rural land in Brazil, and foreign-controlled Brazilian companies can too, as long as they meet legal requirements. This protection gives international buyers more confidence to invest in Brazil’s varied real estate market.

Conclusion

Brazil’s real estate market shows great investment opportunities in 2025. The market recovery has gained momentum. Property values keep climbing in major cities and rental yields outperform mature markets by a lot. The government’s expanded Minha Casa, Minha Vida program helps fix housing shortages and boosts construction across the country.

Foreign investors can take advantage of several positive factors right now. The weak Brazilian real creates an automatic discount when investors use stronger currencies. This means they can buy properties at a fraction of their true value. Tax incentives have made returns even better through faster depreciation, tax credits, and regional tax breaks.

The long-term investment outlook looks promising because of population trends. Brazilians are moving to urban areas, with 57% living in just 319 municipalities. This creates a steady need for housing. The new Electronic Public Records System has changed everything. It cuts down transaction times and makes buying property safer.

Brazil’s real estate market used to be tough for foreign investors. But things are different now. A stronger economy, better laws, tax benefits, and currency advantages make 2025 the perfect time to invest. Smart investors see this rare mix of factors and are jumping in. They want to profit from Brazil’s promising real estate scene before these great conditions change.